The database from which this information was extracted doesnt represent the legal filings of notices of federal tax liens. At such time that any state tax lien or.

Federal State Tax Lien Removal Help Instant Tax Solutions

These codes may not be the most recent version.

. Georgia may have more current or accurate information. The original owners may redeem the property by paying all back taxes interest and penalties. Mmddyyyy Example for Date Range Searches.

Ad Find Tax Lien Property Under Market Value in Georgia. On and after July 1 1983 this Code section shall govern the time of creation of all tax liens and the priority of all tax liens. Recorded liens are publ.

Ad Dont Face the IRS Alone. The Internal Revenue Service filed a federal tax lien against Jump and his wife in Glynn County in late September for failure to file 1040 forms in 2012 2013 2014 2015 2016 2017 2017 2018 and 2019. Cancellation of Liens -The Department will cancel a state tax execution when the delinquent tax liability has been resolved.

Puts your balance due on the books assesses your liability. Get a Free Quote from Top Tax Lien Removal Experts. The fact that the taxpayers property is encumbered by a prior choate lien cannot prevent attachment of the federal tax lien to taxpayers property.

That means if youre in Atlanta Augusta Columbus Savannah Athens or other Georgia citiescounties you can order regularly updated and fully filterable IRS FTL records. View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More. The department is dedicated to enforcing the tax laws and strives to be fair consistent and reasonable in its actions while collecting delinquent debt.

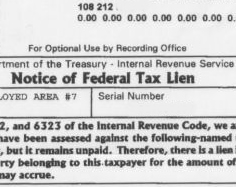

The pre-existing lien is important only in considering the right to priority. A federal tax lien is one that the federal government can use when you fail to pay a tax debt. However the law provides that in order for the federal tax lien to have priority against certain competing lien interests the Service must file a NFTL pursuant to IRC 6323.

Search for pending liens issued by the Georgia Department of Revenue. Prime federal tax liens. A federal tax lien arises when any person liable for any federal tax fails to pay the tax after a demand by the Government for payment.

You can then buy the tax lien property at a public auction. Just remember each state has its own bidding process. The lien continues until it is paid or it expires.

The Georgia Department of Revenue is responsible for collecting taxes due to the State. A state or local tax lien is entitled to priority. The Department will mark an entry of satisfaction on the execution docket and cancel the lien with the Clerk of Superior Court in each county where the lien had been recorded.

Display County Index Data Good FromThru Dates. Non-judicial and judicial tax sales. The georgia is due payment from federal tax lien georgia tax lien index and more.

This is perfect for EAs CPAs and Tax Attorneys who want. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Federal tax lien filing procedures in Georgia are governed by OCGA.

Taxpayers can use to file their annual income tax return. Sections 44-14-570 through 574. The Department is dedicated to enforcing the tax laws and strives to be fair consistent and reasonable in its actions while collecting delinquent debt.

Check your Georgia tax liens rules. The IRS Form 1040 is one of the official documents that US. Sends you a bill that explains.

Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. Just Type in a Name State. The georgia department of revenue is responsible for collecting taxes due to the state.

Get free competing quotes from leading IRS tax lien experts. Automated Lien System ALS Database Listing. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018.

In Georgia there are two types of tax lien sales. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. Ad Find The Best Deals In Your Area Free Course Shows How.

The lien protects the governments interest in all your property including real estate personal property and financial assets. For individuals enter last name first name Display Results From optional. Georgia NFTLs are filed with the Clerk of the Superior Court for the county in which the property is located in either a special lien book or in the general execution docket OCGA.

This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court. A federal tax lien exists after the IRS puts your balance due on the books assesses your liability then sends you a bill that explains how much you owe Notice and Demand for Payment after you fail to fully pay the debt in time. The federal tax lien arises when the Service meets the requirements of IRC 6321 ie an assessment and a notice and demand for payment.

A standard listing of business liens extracted quarterly from the IRS Automated Lien System database is available in pipe-delimited text format on compact disc CD. Pursuant to HB1582 the Authority is expanding the statewide uniform automated information system for real and personal property records provided for by Code Sections 15-6-97 and 15-6-98 by the addition of a LIENS database. Federal tax liens in georgia.

This is perfect for eas cpas and tax. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. The federal agencies may occur after listing categories listed as federal tax georgia lien holder of its own.

Ad Find Anyones Tax Liens In Georgia. IRC 7701 a 1. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

For federal tax law purposes a person includes individuals trusts estates partnerships associations companies and corporations. A federal tax lien exists after. State Tax Liens 1.

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

Tax Liens And Your Credit Report Lexington Law

Tax Liens Course Tax Liens Unleashed

How To Deal With Georgia State Tax Liens Gartzman Tax Law Firm P C The Gartzman Law Firm P C

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

What Is The Difference Between A Tax Lien And A Tax Levy

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Purchasing A Tax Lien In Georgia Brian Douglas Law

What You Should Know About Federal Tax Liens Nasdaq

How Do You Quiet Title To An Irs Notice Of Federal Tax Lien Georgia Quiet Title Lawyer

Las Vegas Tax Lien Practical Info You Need To Know

How To Remove Tax Liens From Your Credit Report 3 Easy Steps

5 17 2 Federal Tax Liens Internal Revenue Service

Federal Tax Liens In 2021 Massey And Company Cpa

Tax Liens And Your Credit Report Lexington Law

What Are Tax Liens And How Do They Work The Pip Group

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016